Where and how is liquidity created for digital assets?

The evolution from crypto to new capital markets for real assets has long been underway, with more and more asset classes being tokenised. What is still missing for a breakthrough is the liquidity of such tokens. This will develop in secondary markets. Tokenisation itself is ‘just’ a new type of securitisation – a securitisation that can be made cheaper and more efficient through integration with blockchain technology.

Assets always need a market

When a thing is tokenised and thus becomes a digitally tradable asset, this initial act is similar to securitisation, also known as ‘origination’, in the traditional world. This means that the asset is first registered on a DLT infrastructure.

Distribution to investors is usually done by raising capital from issuers to investors via the primary market (primary allocation of tokenised securities from the issuer to investors). This is also referred to as distribution, as the issuer (or its intermediaries) actively seeks investors to invest in the company. The primary market can be both private (private placement) and public (public placement).

But how does a tokenised asset ultimately reach the masses? This is where secondary markets play a crucial role. They allow securities that have already been placed with initial investors to be publicly traded by anyone. There are also hybrid forms where securities are offered directly to the public via a stock exchange.

In order for securities to be actively traded between investors on secondary markets, not only a technical platform is required, but also a certain degree of liquidity, i.e. the availability of supply and demand for trading. Creating this liquidity is a key function of secondary markets. They bring together as many investors as possible (traditionally through investment firms) and so-called market makers, who quote prices for the securities on a daily basis.

Ingredients for liquidity

A key lesson from tokenisation projects so far is that technology alone is not enough. In other words, tokenisation is not the same as liquidity and requires not only the market but also capital. Although tokenisation theoretically increases the (technical) tradability of an asset, without the necessary liquidity from a broad range of capital providers, little trading can take place in practice.

So how is liquidity created for tokenised assets? Not at the touch of a button, that much seems clear. Even if secondary markets cannot generate liquidity at the click of a mouse, there are several aspects that favour liquidity:

- Legal certainty: A clear and effective regulatory framework protects investors and promotes overall market integrity. Regulation favours institutional capital that is professionally managed and has a high level of risk management.

- Quality standards: Issuers and their assets must be of high quality. Quality criteria need to be defined and enforced.

- Broad access: Retail and institutional investors must have easy access to tokenised assets.

- Transparent market data: Transparency in the form of easily accessible, timely and reliable market data enables informed investment decisions. The smart contracts of tokenised assets must include all key attributes so that third parties can independently value the assets.

- Presence of market makers: Transparent market data allows prices to be mapped, encouraging the presence of specialised trading firms such as market makers.

- Tokenised payment token: A widely accepted stablecoin enables direct trading or direct settlement on the cash leg.

There are secondary markets – and secondary markets

If anyone can fulfil these attributes for a liquid market, it is the regulated secondary markets. They are licensed as a regulated market, issue quality assurance standards and can also tap into the large liquidity pools of regulated institutions such as banks. They can also provide transparent, structured market data, work with professional market makers and handle settlement against payment.

DLT trading system – a world first

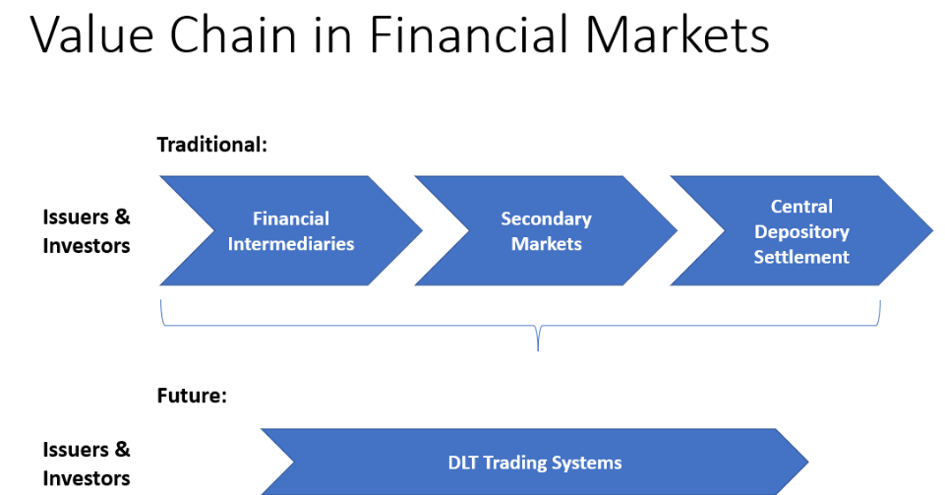

In Switzerland, a new category of licence has been created to remedy this situation, the so-called DLT trading system.

This legal licence category combines the best of both worlds: direct access for investors and issuers and the legal certainty guaranteed by Swiss law. Trading, clearing and settlement are integrated into a single licence. This greatly simplifies the financial market infrastructure and finally allows it to benefit from the advantages of blockchain technology. Trading on the chain becomes possible.

Quelle: Liquidity Paper (Swiss Blockchain Federation)

This is where BX Digital comes in, the first exchange to apply to FINMA for a DLT trading system licence. The central element is direct settlement against cash and the transfer of assets via a public blockchain – without the need for central counterparties, such as clearing houses and central securities depositories. This is also referred to as ‘the trade is the settlement’.

This will not only save time and money, but will also enable the trading of entirely new asset classes (e.g. tokenised equities, bonds and potentially real assets). To create liquidity, BX Digital will implement the aspects mentioned above, namely regulatory certainty for a broad network of trading participants, quality standards for listing and trading, transparent market data, presence of market makers and easy settlement against cash.

In this interview, Claudio Tognella (Director of Sales and Business Development, BX Digital) and his guest Guido Bühler (owner of GILOCA AG) discuss the fascinating technology of tokenisation and the challenges of liquidity for investors. Guido Bühler, known as the co-founder of Amina Bank AG, shares his experiences and explains how tokenisation of assets affects liquidity.