Are you a bank or securities firm looking to participate in the regulated market for digital assets?

Would you like to develop new products and services based on digital assets? Would you like to expand your liquidity services to include the new segment of digital assets? Are you looking to provide your clients access to the asset class of the future? Do you need a reliable, regulated peer-to-peer settlement mechanism for digital assets? Do you have clients planning to issue digital assets and looking for a secondary market?

Would you like to develop new products and services based on digital assets? Would you like to expand your liquidity services to include the new segment of digital assets? Are you looking to provide your clients access to the asset class of the future? Do you need a reliable, regulated peer-to-peer settlement mechanism for digital assets? Do you have clients planning to issue digital assets and looking for a secondary market?Are you a bank or securities firm looking to participate in the regulated market for digital assets?

Want to develop new products and services based on digital assets? Want to expand your liquidity services into the new digital asset space? Looking to give your clients access to the asset classes of the future? Need a reliable, regulated peer-to-peer digital asset settlement mechanism? Do you have clients who are planning to issue digital assets and are looking for a secondary market?

Want to develop new products and services based on digital assets? Want to expand your liquidity services into the new digital asset space? Looking to give your clients access to the asset classes of the future? Need a reliable, regulated peer-to-peer digital asset settlement mechanism? Do you have clients who are planning to issue digital assets and are looking for a secondary market?BX Digital offers a highly efficient Delivery versus Payment (DvP) infrastructure for the settlement of digital assets.

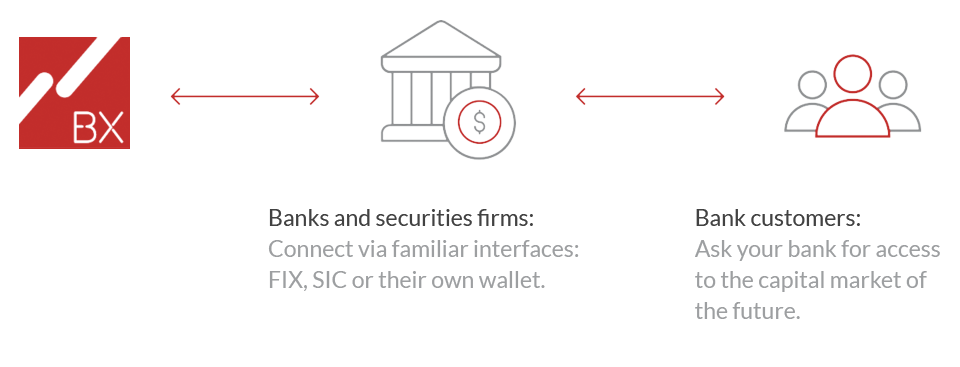

Banks and securities firms – Our value proposition

BX Digital provides banks and securities firms with seamless access to the capital market for digital assets in a regulated and reliable environment.

To facilitate this, BX Digital offers an easy-to-use interface through familiar systems.

Are you ready for the capital market of the future?

Opinions

We started as pioneers with blockchain technology back in 2016. We want to take a look into the future and prepare ourselves well for it, as one of the fastest growing asset classes in the world is currently emerging.

Serge Kaulitz

Technology is the core activity of every bank. Blockchain offers companies in the Swiss financial center great market opportunities.

Milko Hensel

We want to offer our private clients easy access to tokenized products that interest them the most and that they cannot access through traditional financial institutions.

Philippe Meyer

I believe that by 2030, it will be fully normal to invest in Gold, Swiss Startups and Real Estate via Tokens.

Charles-Henry Monchau

A liquid secondary market is essential for the adaptation of real-world asset tokens. Without this, tokenization remains a concept without commercial success.

Guido Bühler

BX Digital harnesses innovation in a regulated environment and connects the decentralized world with the traditional financial world.

Darko Stefanoski

As a bank, we do not want to stand on the sidelines, but rather actively engage with new basic technologies. The example of cryptocurrencies shows that there is a growing customer need for intuitive banking solutions in new technologies.